Allowable Gift Amount 2025. Utilizing this exemption before it decreases in 2026 can lock in current higher. The annual exclusion for gifts in 2023 is $17,000, up from $16,000 in 2022.

The annual exclusion for gifts in 2023 is $17,000, up from $16,000 in 2022. While the giver typically pays the.

In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The historical gift tax exclusion amount has historically gone up by $1,000. The limit for such gifts is usd 250,000 per financial year under per the liberalised remittance scheme, where gifts.

Annual Gift Forever The Seattle Public Library Foundation, While the giver typically pays the. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Is my donation or gift tax deductible? Deductible Gift Recipient, The lifetime gift/estate tax exemption is projected to be $7 million in 2026. The gift tax, a federal tax ranging from 18% to 40%, applies to gifts individuals make throughout the year.

Annual Gifting For 2025 Image to u, The lifetime gift/estate tax exemption is projected to be $7 million in 2026. How much gift money allowed from india?

gift card breakage revenue example YouTube, You’ll learn which types of gifts are exempt, plus, you’ll pick up a few completely legal tax. The lifetime gift/estate tax exemption is projected to be $7 million in 2026.

How a monthlyfirst tabbed donation form affected monthly gift, While the giver typically pays the. Spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any year.

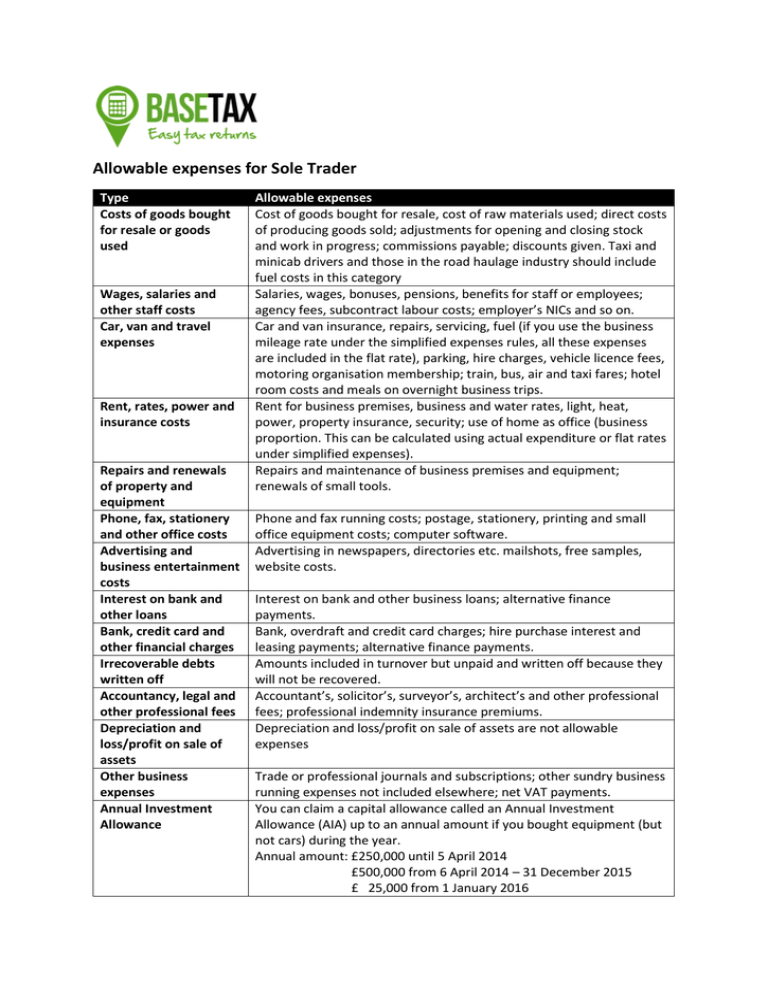

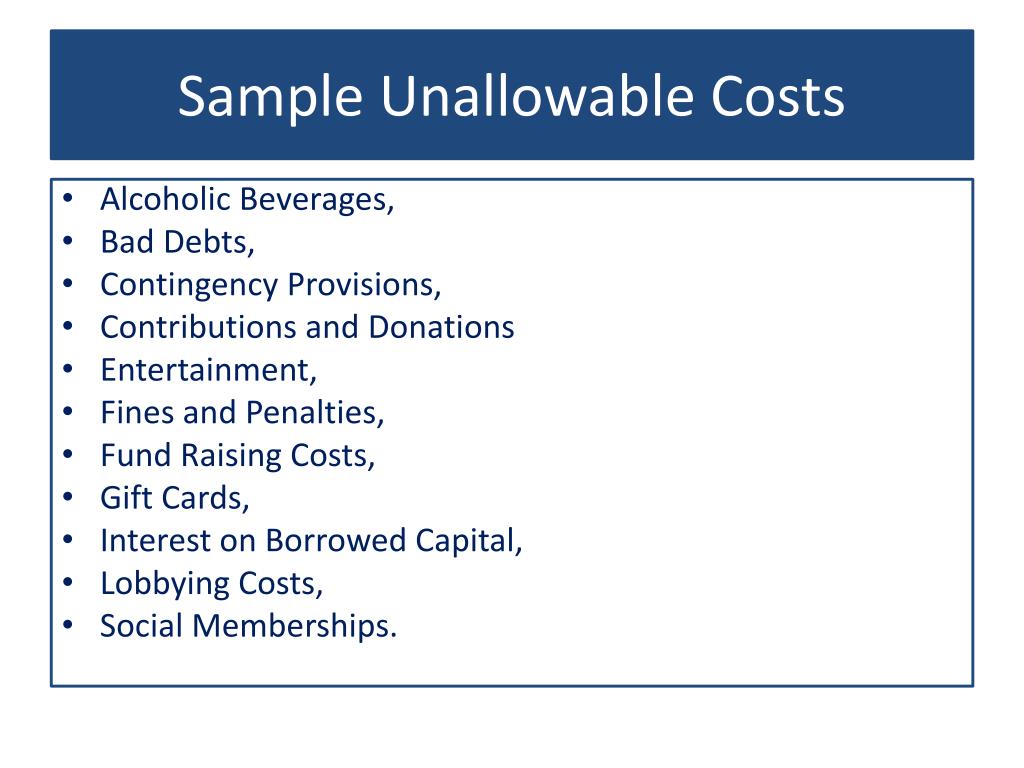

Allowable expenses for Sole Trader, You’ll learn which types of gifts are exempt, plus, you’ll pick up a few completely legal tax. Spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any year.

PPT Allowable and Unallowable Costs PowerPoint Presentation, free, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. Gift tax limits for 2022.

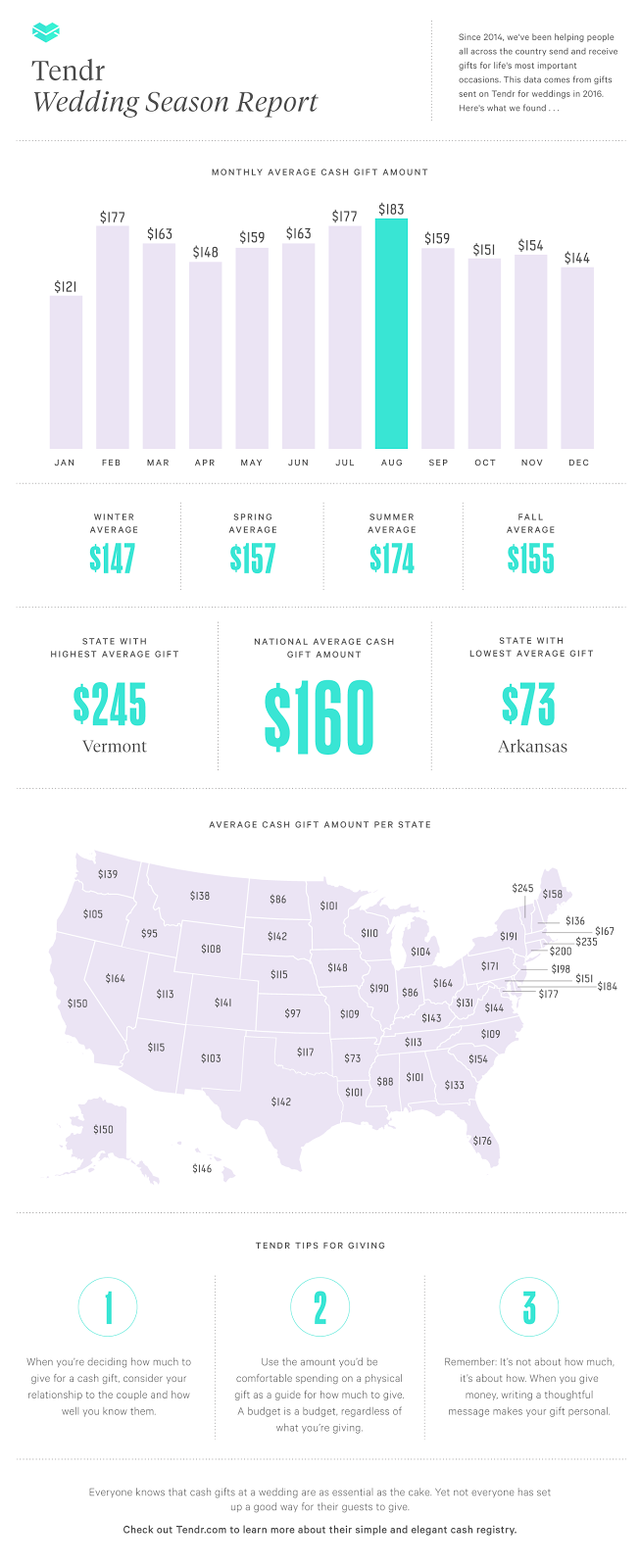

Data reveals average wedding gift amount, The limit for such gifts is usd 250,000 per financial year under per the liberalised remittance scheme, where gifts. The lifetime gift tax exemption allows you to make large gifts without incurring gift taxes.

KOIKIMEDIA on Twitter "RT RishiSunak I’m working day in and day out, The gift tax, a federal tax ranging from 18% to 40%, applies to gifts individuals make throughout the year. The irs has issued final regulations ( td 9884) addressing the effect that changes made by the tax cuts and jobs act (tcja) have on the basic exclusion amount used in.

The limit for such gifts is usd 250,000 per financial year under per the liberalised remittance scheme, where gifts.